Give Me 5 Days and I’ll Show You How To Access Unlimited Capital To Purchase Profitable Multifamily Properties

Free Course: #1 Most Trusted Real Estate Syndication Coach Reveals How To Acquire Multifamily Properties Using The Hidden Secrets Of Wall Street Fund Managers.

Free Bonus – get Your First Syndication in 180 Days action guide

A blueprint to plan and track your progress to financial freedom

Discover How To Acquire Multifamily Properties Using Other People's Money

This isn’t just any online course… It’s an instruction manual where you'll discover how to find off-market properties, accurately determine if they will be profitable, get them under contract, get the deal financed, and increase the value through forced appreciation…

…Everything you need to enter the world of multifamily investing...

Bonus to the first 100 to sign up...

Your First Syndication in 180 Days action guide

A blueprint to plan and track your progress to financial freedom.

If you invest in single-family homes STOP and read this before missing out on the biggest income opportunity in the last 75 years

From: Vinney (Smile) Chopra Danville, California

Has this happened to you?

You save for a down payment, purchase a house that needs a little work, fix it up, rent it to some friendly people, and you’re off to find your next property, right?

Wrong...

If you invest in single-family homes STOP and read this before missing out on the biggest income opportunity in the last 75 years.

From: Vinney (Smile) Chopra

Danville, California

Has this happened to you?

You save for a down payment, purchase a house that needs a little work, fix it up, rent it to some friendly people, and you’re off to find your next property, right?

Wrong...

Twelve months later, they move out…

The carpets are destroyed

Holes in every wall in the house

Punch holes in bedroom doors

Rancid food in the fridge

Garbage everywhere

Walls need painting

The entire house needs more than TLC, it looks like it should be torn down.

All your positive cash flow down the drain, and you’re reaching into your pocket for more money.

Worse than that, you have to make the mortgage payment while the property is vacant, and you have ZERO income from this property until it's re-rented.

I know the struggle…

I came to America in the 1970s to get my master’s degree. I had less than $7 in my pocket when I got here.

Once I established myself, I began investing in single-family homes. I'll tell you more about my start and how I got on my feet in the book.

The problem with single-family investing is you have one door, one roof, and one tenant, so all of your costs are higher. It's nearly impossible to scale unless you can get to 50 or so houses.

But getting to 50 houses is like having two extra jobs. You have to be the acquisitions, rehab, and rent collection manager while keeping your finances in order.

I learned that single-family homes are the slowest, most unreliable way to make money in real estate.

Then I learned about how to acquire multifamily real estate through syndication.

Since then, I've acquired over ¾ of a BILLION in multifamily real estate assets using

syndication. And I’m here to tell you…

The future of real estate investing is Syndication.

You may be thinking, wait, Vinney, what the heck is syndication?

Great question.

Syndication is when multiple people pool their money with an experienced investor, which allows the group to acquire larger properties than they would otherwise be able to on their own.

Kind of like crowd funding but with a higher caliber of investors.

Why Multifamily?

Besides the disaster, I described before -

Multifamily real estate provides:

Monthly cash flow without having to do work to get paid

Appreciation. As you add value and increase net operating income, the value rises

Depreciation. One of the biggest reasons people enter multifamily investing is depreciation's tax benefits.

Too many investors have their future hope in appreciation, but market swings and increased interest rates have set up the market for a correction more significant than 2008.

In an unstable market, the #1 most important factor is income…

And in multifamily, you can have predictable income and protection from massive losses in a market downturn or crash.

And as long as you have income, you can pay your mortgage and other expenses.

DON'T GET ME WRONG... INVESTING HAS RISK...

But if you know how to...

Find Off-Market Properties And Acquire Them Before Anyone Else Finds Out They Exist

Accurately Determine Their Value, So You Never Pay Too Much

Raise The Down Payment Money From Private Investors

Qualify for the Loan

You can create a great business as a multifamily syndicator.

Once you learn the art of syndication, you can build a multifamily real estate empire.

That's why I'm offering a free digital copy of my international best seller; Apartment Syndication Made Easy.

I want you to know everything I know so you can be a successful syndicator.

Bonus to the first 100 to sign – get the free audio book - listen while you read.

You’ll retain 57% percent more when listening while reading.

Market changes are coming HERE

Fund managers know a correction is on the horizon...

But they don’t want you to know because they stand to make billions.

You can position yourself to be first in line to capitalize on the biggest transfer of wealth since the great depression.

If what I see is confirmed, a major market correction is coming in the single-family investing. And many, who have been enormously successful in the past, are headed for a disaster of biblical proportions…

History has shown when interest rates rise, gas prices are high, and inflation is high, a significant market event is coming.

What you do now can allow you to escape unscathed and position you to be prosperous beyond your wildest dreams over the next 12 to 36 months.

Look, there are many ways to make money with single-family homes and small multifamily properties, but all of them leave you overworked and, in many cases, underpaid.

The reason most never venture into multifamily investing is because...

You think it’s too complex (it can be if you don’t have someone to guide you)

You don’t have the down payment money and don’t know where to find the money

You have good credit but not enough to qualify for multimillion dollar loans

Single family investing is easier and can be quick money

Doesn't require as much cash (many properties can be purchased with no money or credit)

Fear that there’s too much risk

But there’s good news.

In Apartment Syndication Made Easy, you’ll discover how I went from $7 to acquiring 750 million dollars in multifamily properties using other people’s money…

And how you can too. Don’t wait to get started.

Bonus to the first 100 to sign – get the free audio book - listen while you read.

You’ll retain 57% percent more when listening while reading.

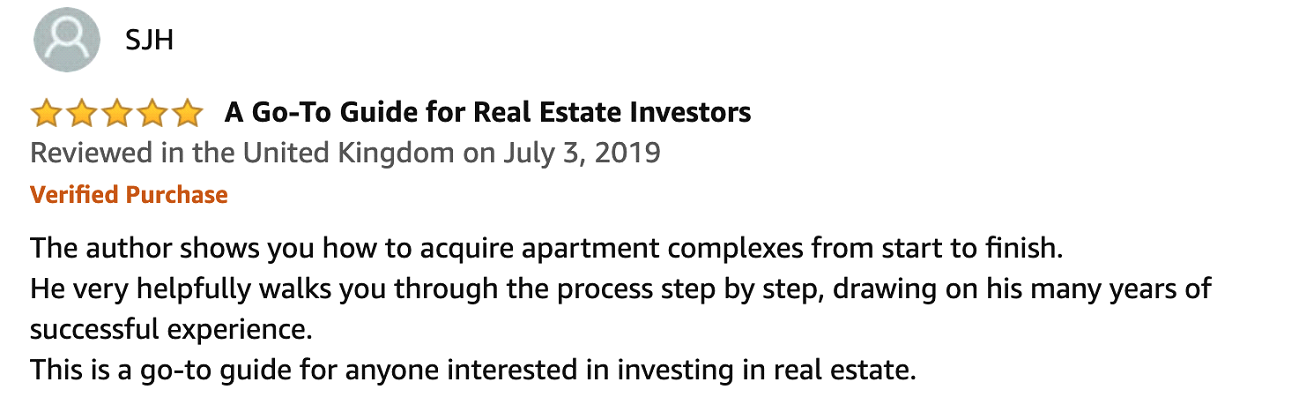

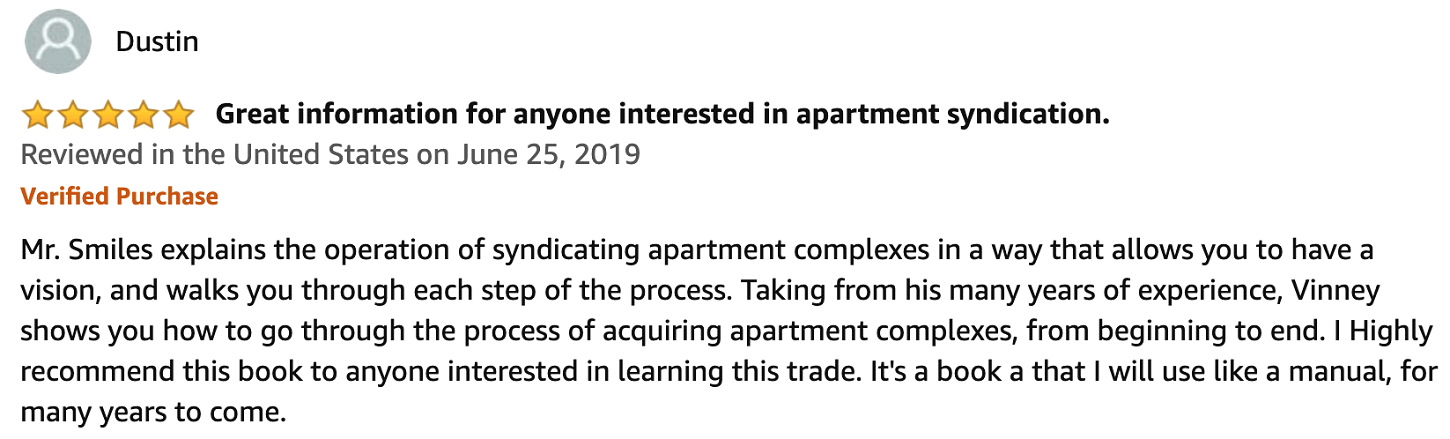

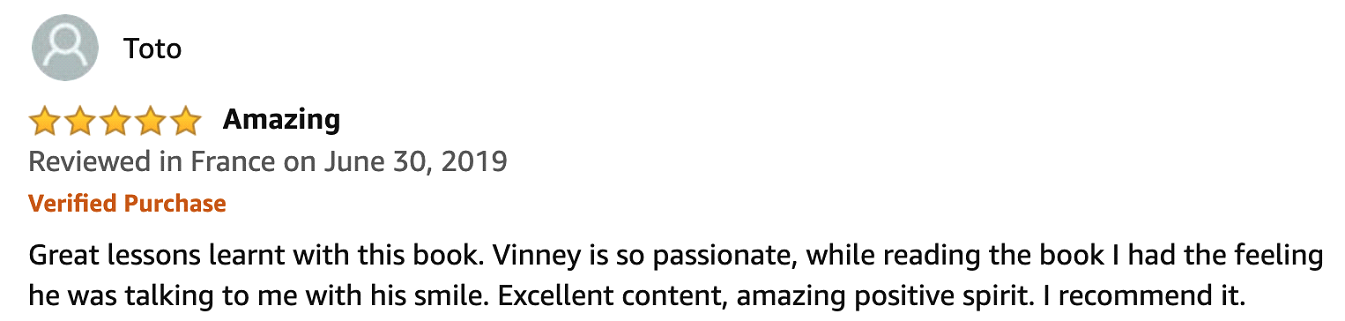

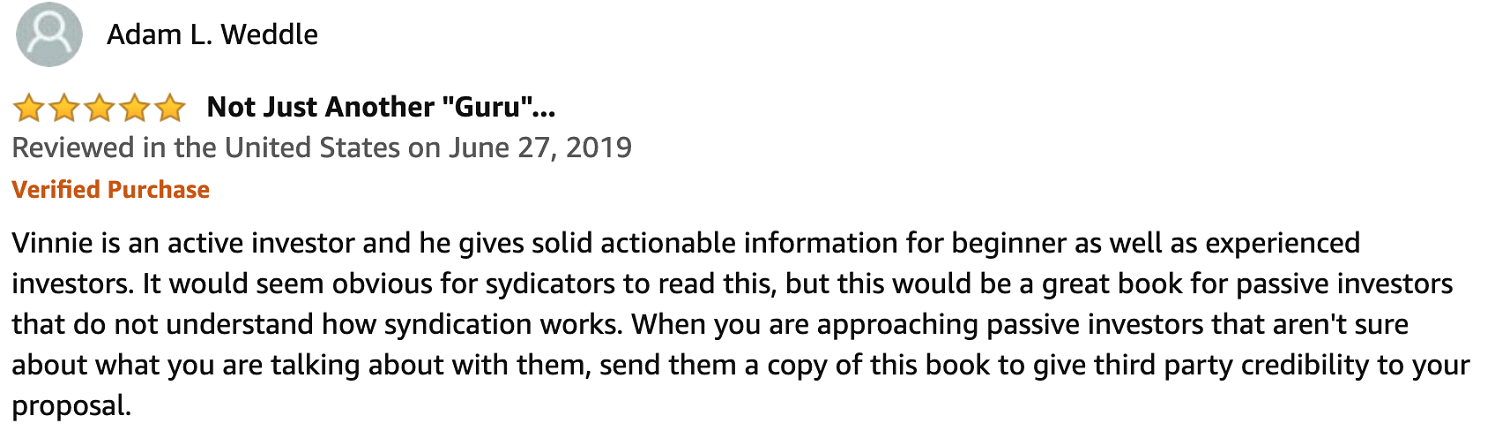

Our Reviews

Several takeaways for me:

As mentioned in my review, it is really hard to read or watch anything you do without getting motivated or thinking, "I can do this!" It's easy to see someone like yourself who has several hundred million dollars of assets you control and want to be there right away. It takes time and you make it seem possible, which it is...especially with your story of struggle in the beginning. (I haven't "syndicated" a deal yet, but have a 66 unit here in Phoenix.)

A lot of the granular info on where you collect data, reports, market info and forecasting was very helpful.

One area that caught me by surprise in doing a larger deal was all of the up-front costs associated with the loan...the graph and fee breakdown was not all new to me, but I appreciated that. Knowing exactly what to expect in fees can certainly help someone new be prepared.

I always like seeing how people structure their deals as far as acquisition fees, management fees, dispo fees - want to be fair and provide a great product to investors, so it was also helpful to see how you think about those things.

Privacy Policy | Terms & Conditions | Disclaimer

©2022, All Rights Reserved.